More Fraud at Toronto Dominion Bank?

How Canadian banks torched their reputations with profit seeking off the immigration crisis

Welcome, Avatar!

Recent headlines brought back to mind some of the stories I had to cut from the recent Canada deep dive post (would recommend reading if you haven't yet).

I have a friend who works at the fabled institution and oh man, the stories I've heard from him in recent years would explain why I was not surprised at all when one of Canada's biggest banks, Toronto-Dominion (TD) Bank, was hit with a $3 billion dollar fine from the US Department of Justice.

What were the allegations?

Multiple large scale money laundering operations had been uncovered along with rampant missing source of funds investigations and compliance oversights.

No doubt, they likely still profited even after the fine, just like HSBC charged for similar activities in 2012.

As with the credit card churners, it appears that criminal organizations also do rotate through the banks as one gets caught, and others lower their standards to pump their quarterly numbers.

Today, is an off the record exclusive set of stories on TD Bank and how Canada's so-called pristine banking sector has veered off into dangerous territory to make a quick buck on the immigration crisis destroying the country.

First off, a special thank you to the readers who pay to make this newsletter possible.

Your kind words, success stories, and support go a long way.

Want your own success story? Start here and report back your wins. It’s a growing club of winners, and we’re waiting for you to join.

– Fullstack

Let's Set the Stage

As we went deep into in the Canada deep dive post, the country is in the midst of an unprecedented influx of foreigners, with a mix of millions of legal immigrants, student visas, refugees, asylum seekers, and temporary foreign workers.

Millions each year entering a country of 40m.

The pace is utterly unsustainable in all aspects of society from education to healthcare, crime to labor markets, and obviously real estate to boot.

While the government recently admitted to waiving numerous background checks across immigration programs to get through the backlog of applications faster, Canada's banks seem to have run the same playbook.

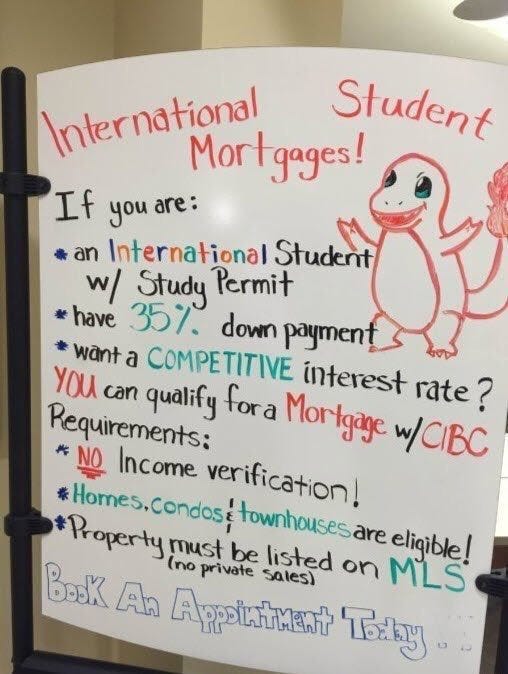

While mostly unscathed from the bank crisis in the 2008 Great Recessions, Canada's government charter bank oligopoly has plowed into riskier ways to make money ranging from riskier mortgage lending, straight up money laundering, and a strong focus on banking the foreigners entering the country with numerous easy mortgage programs for foreign students and ad campaigns in arrival airports pushing their different products.

What is shared below, anonymized and off the record from my sources in TD, paints a picture of how the bank managed to be in the middle of some of the biggest trends in the nation, and make a handsome profit doing it.

Foreign Student Deals

If you have flown through a Canadian airport anytime in the past year, you'll have encountered the endless arrival hallways on the way to customs solely with bank advertisements targeted at recent immigrants and foreign students.

Credit cards, special mortgage rates, new account signup fee waivers, the banks have opened their wallets to try and lock newcomers into their institution.

And given their earnings, it has been working.

But, what are the long term prospects of low skill foreign labor getting a fake diploma and living 10 to a house because they can't get a job?

Will they really long term be able to get legal status and a high paying job?

Will they pay their credit cards? Even if they're not used to having access to credit back home?

Will they make their mortgage payments for the next 25 or 30 years? With a variable rate?

Bank sales managers have had little time to ponder these pressing questions, many too busy rubber stamping applications for back office approval and trying to get their bonus for the year.

The level of exploitation of the immigration crisis by every industry is staggering the more information comes out. Many, especially the universities and colleges, are actively lobbying to keep the party going.

Immigration Sponsorship Asset Pool

One of the immigration background checks which was selectively ignored by Canadian immigration officers was the minimum asset requirements for documented individuals in the country who were trying to sponsor a new applicant.

For example, a family lands in Canada as a legal skilled immigrant. After a few years, they've saved enough money to apply to bring their brother and his family.

And while the government opened the door for people to apply even without sufficient assets, leading predictably to a spike in asylum claims as illegible candidates were not pre-screened and rejected and instead allowed to land on Canadian soil and make refugee claims; TD bank was party to a different approach.

Some communities had a different scheme running.

Since many members had been in the country for a long time, and they retained the tribal levels of loyalty & honesty – and otherwise harsh enough accountability to enforce good behavior – ethnic communities were able to share assets and in a different way dodge the government minimum asset requirements.

In one case, members of the same community would come in to deposit tens or hundreds of thousands of USD, in cash from a backpack, into an account which had dozens of authorized users on the account. Any user could withdraw any amount of money at any time, and yet bank staff noticed that they never did, despite the growing pile of funds – well over $1 million dollars in some cases.

Instead, the only withdrawals would be to a new authorized user, and in fixed predictable amounts, usually $10k or $20k – which of course match exactly up with the government minimum asset requirements to sponsor new applications.

Once the new family arrived after their successful application, they would work like dogs to repay the loan – with some additional amount (for religious reasons not necessarily interest). This is why the shared account would continue to compound up and up.

Bank officials would continue to push account members towards investing or other wealth management products when they came in to deposit or withdraw, but no one ever budged or was interested at all.

And so, the same assets in the community would be laundered from family to family to bring whoever they wanted over, long before they would have been able to have the necessary assets to sponsor a new application themselves.

New Manager, New Rules

A new ethnic manager was brought into the branch at one point, apparently to boost sales.

And that he did.

Every application – credit cards, mortgages, HELOCs, cash advances, new accounts – was approved.

Minimal due diligence, it all got stamped and sent to the back office. Fake income documents or personal letters too, whatever it took to get the account approved and counted towards the branch sales numbers.

Tellers that didn't go around with the rubber stamp sales pipeline were managed out of the branch, and new ethnic employees were brought in. Within a year, almost all tellers were the same ethnicity as the manager.

Within 18 months, head office started to get concerned that these sales numbers were not simply great performance, and swapped in a white lady.

Immediately, she was shocked with the lack of following of standard procedures and cracked down, dropping some of the tellers, and putting others through rigorous new training.

Sales numbers for the branch plummeted.

Sales Quota Swapping

But that old ethnic manager wasn't fired, no he was just moved to another branch.

And he ran the same playbook there, taking it even further to call managers from branches in other cities and offer them under the table payments to send clients to his branch when his numbers were low. Clients would sometimes drive over 100 miles, but managers involved in this scheme were always top of their district and would qualify for the annual paid vacation.

Without a common, shared sense of ethics and honesty, all of the usual sales promotions and guidelines were overrun by the win at all costs mentality of the new managers brought in.

Notably, this increasingly had implied approval from the top of the bank as a new ethnic CEO had gradually managed out all VPs and leadership from other ethnicities and hired in his own people. The same approach has gradually happened and implicitly been approved across the entire organization.

Cash Grocers

Some new immigrants arrive with a long history of success from their home country.

One in particular ran a successful grocery business. And predictably, coming from a country without credit markets, the entire business was operated with cash.

Farmers, produce, meat distributors, were all paid in cash. Staff were paid in cash.